With regard to global stock markets, are still looking bearish corrections of any relevance, both in central countries emerging. Our basic recommendation is to not have positions in significant weighting in the Portfolio shares. You must wait until there are clear signs of positive trends.

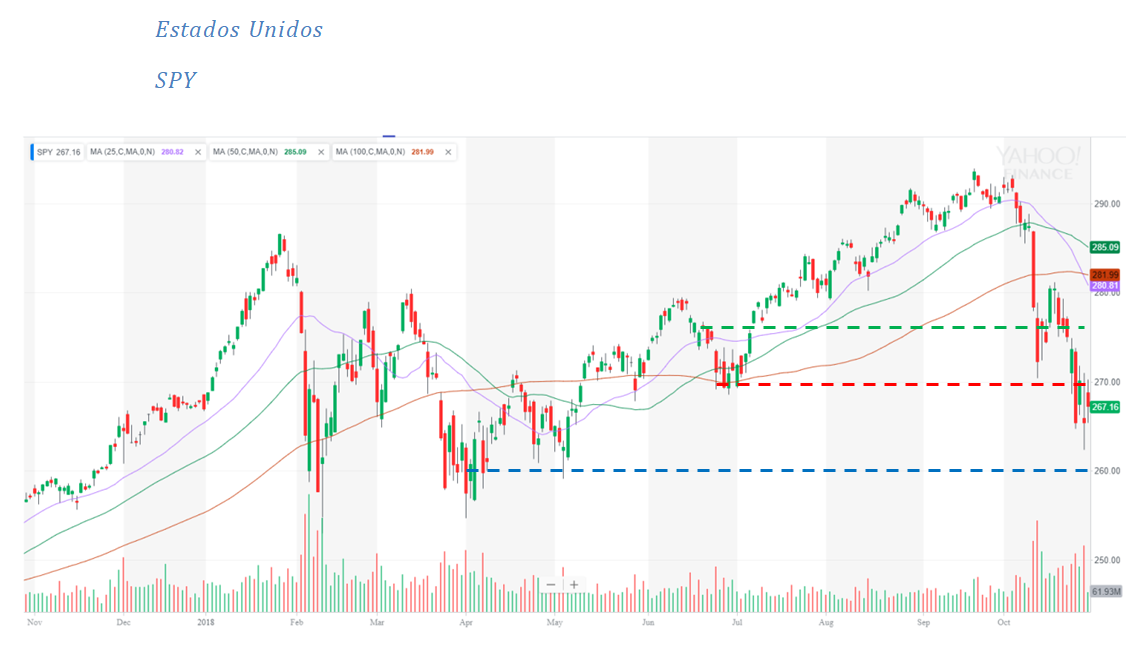

The past 10 October we indicate signs of downward trend regarding the evolution of the US stock market. Since then, the evolution of the SPY (ETF composed by 500 companies) evidenced brackets that were key breaks and accumulated several days of significant casualties. In total, in October, builds up a low on the 8,50%.

We remind that a bull market in the United States is not enough for similar behaviour in other countries, but If it is essential to not be a negative trend to enable other markets recorded.

- The main trend is bearish.

- He broke the stand at USD 270 and deepened losses.

- Currently, the next support is at USD 260. Break it, It could extend the low.

- To recover a positive trend, You should overcome the level of USD 275 and to hold up during several wheels.

- The short-term moving average cut down their counterparts in the medium and long term.

- After reaching highs of 3,25%, It continued to show slight falls and is currently located in lathe to the 3,10%-3,15%.

- The main trend is still bullish.

- We estimate a rate of 10 years in 3,50%-3,60% the coming year by mid-century.

- It stays within the bearish channel.

- Slight rise in the past few days after hitting the support at the level of USD 36.

- To consolidate a trend reversal should break the level of USD 45.

- We recommend the break above resistance before taking positions.

- It keeps the negative trend.

- To achieve a change of trend you should break the level of USD 25.

- We do not recommend to have positions.

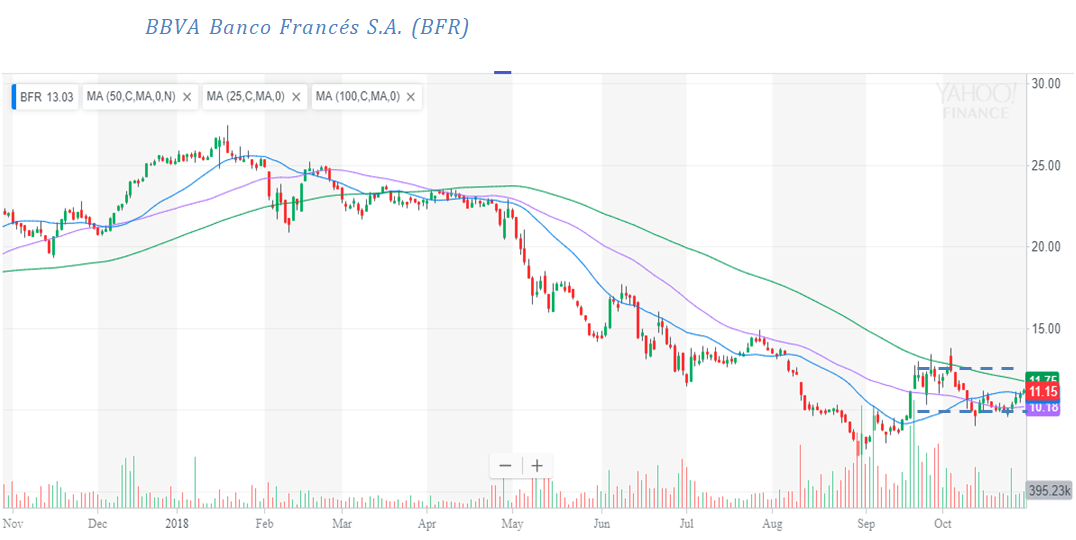

- Held lateralizando between USD 12,50 and USD 10 Since mid-September.

- To consolidate an uptrend it should break the level of USD 12,50.

- We recommend to have positions with stop-loss at the level of the channel support.

- Is testing key resistance at the level of USD 8.

- Break this resistance, settle a new uptrend.

- We recommend to have positions with stop-loss in USD 7, current support.

- It stays within the bearish channel.

- He broke down the support at the level of USD 12,50, deepening trend.

- We do not recommend to have positions.

- He is currently lateralizando in levels between USD 17 and USD 20, without a clear trend.

- To consolidate an uptrend it should break the level of USD 20.

- It stays within the bearish channel.

- It maintains support at the level of USD 21.

- To consolidate a trend reversal must break the level of USD 24.

- It stays within the bearish channel,

- I am a support at the level of USD 30.

- To achieve a change of trend you should break the level of USD 35.

- We do not recommend to have positions.

- It stays within the bearish channel.

- Mild bullish rebound in recent days after hitting a floor at the level of USD 13,50.

- To consolidate a trend reversal must break the level of USD 16,50.

- The main trend is still negative, Despite the strong bullish rebound during the month of September.

- I am a support at the level of USD 13.

- To consolidate a trend reversal must break the level of USD 16,50.

- We recommend to have positions with stop-loss in USD 12,50.

![]()

As for Brazil, consummate Bolsonaro victory in presidential elections, the evolution of assets seems to show that the former military victory was discounted in prices.

- After mark a double floor in USD 32 and break a first resistance in USD 37,50 at the end of September, EWZ continued moving upward until you find a second top level, around USD 40.

- In this level is ranging from early October.

- It is important that you get to break the USD 40 during the upcoming wheels to continue the upward trend.

- Downward, key support is in USD 37,50.

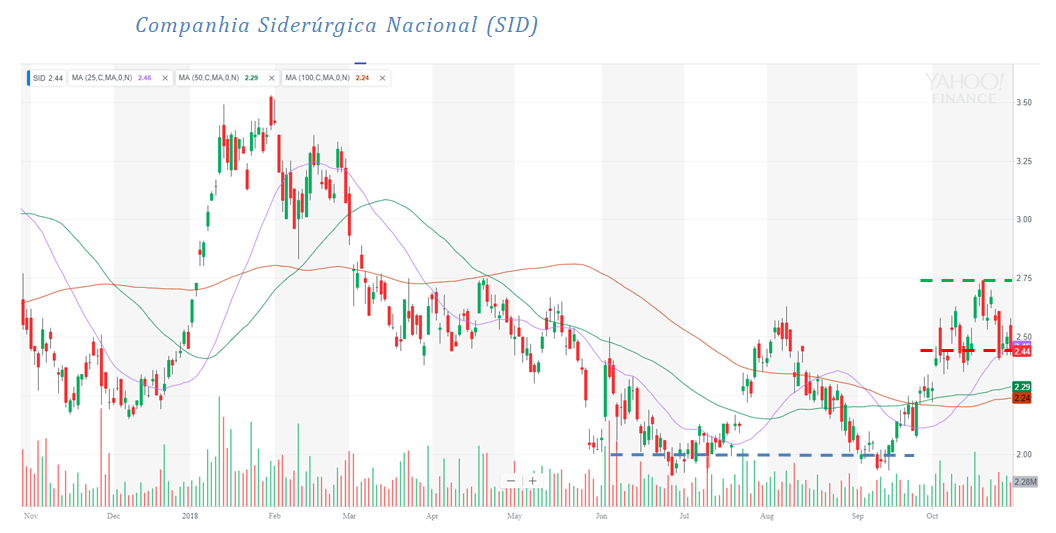

- Similar to the EWZ graphic, with a double floor around USD 2,00 and a bullish rally since the beginning of September.

- He found strength in USD 2,65, approximately, and support in USD 2,45 (current level of the average of short-term).

- Consolidated the break stand at USD 2,45, You can return to the minimum levels reached at the end of June and beginning of September (USD 2,00).

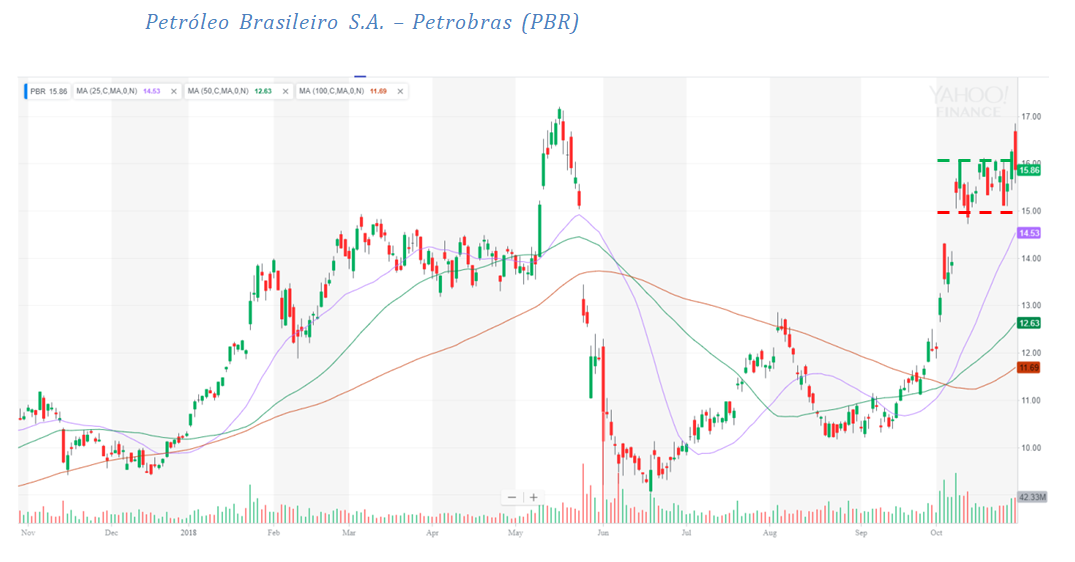

- It shows the same upward trend that started the Brazilian stock exchange in early September.

- Currently, found in levels of resistance in USD 16,00.

- Downward, the level control is in USD 15,00.

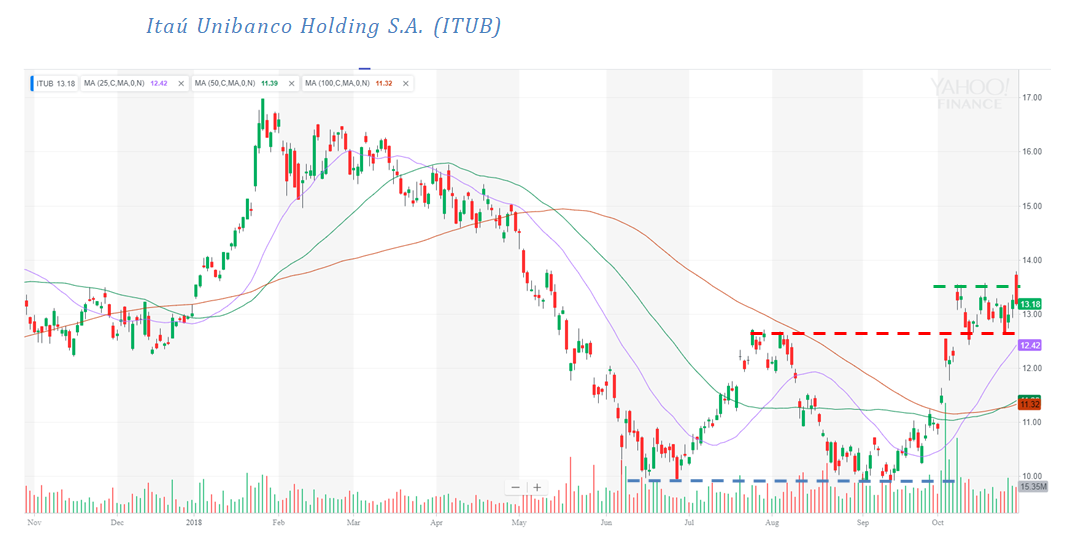

- It accompanies the general trend of the stock market of Brazil: a double floor (in USD 10,00) followed by an upward trend since the beginning of September.

- During the bullish rally, broke a resistance in USD 12,50 and formed a second in USD 13,50.

- For the continuation of the trend, It is important that you get to break this second resistance.

- Within a bullish channel since the beginning of year.

- In September accelerated hikes, accompanying the rest of the Brazilian actions, He broke on the upside the main channel and found strength in USD 16,00.

- From the top, accumulate successive falls who returned to situate it within the channel.

- Currently, prices near to a level that can be considered is support, approximately in USD 14,60.

- If you respect the support, You can start a new attempt of break on the upside of the channel. On the other hand, failure to comply, casualties could continue until the lower boundary of the channel USD 13,00.