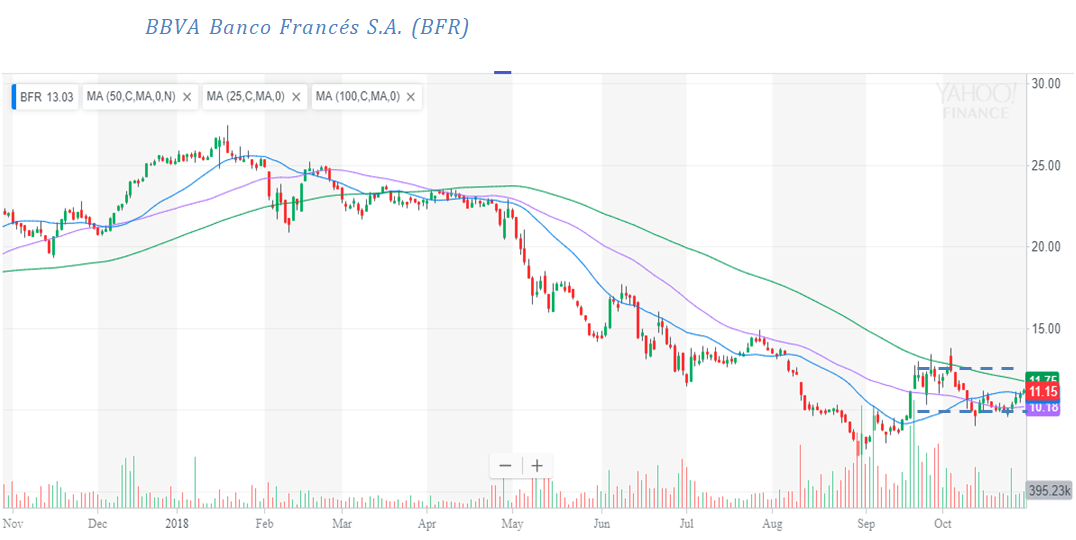

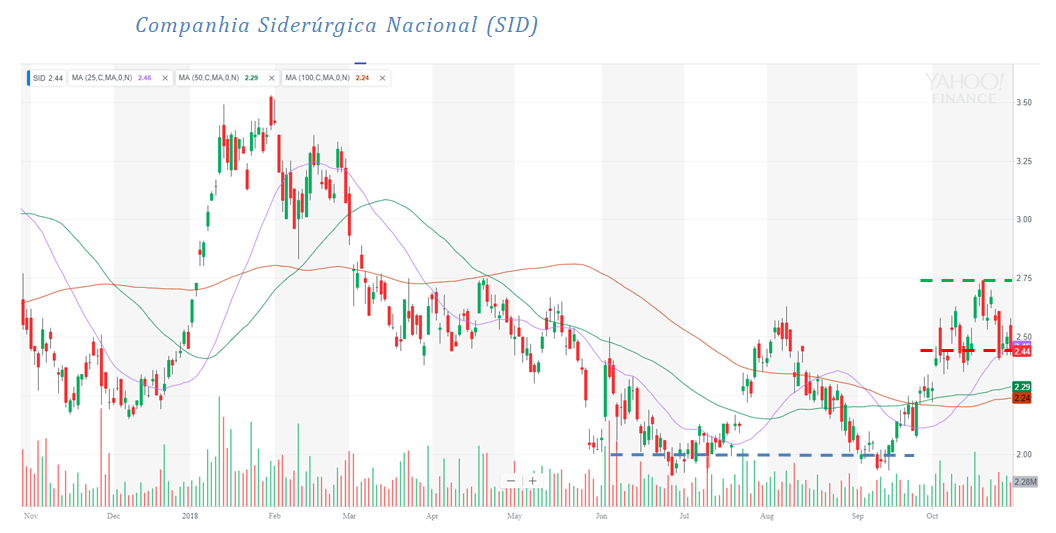

The clearly negative trend observed in the Argentine actions, It is enhanced with some negative behaviors on top-level exchanges and in emerging.

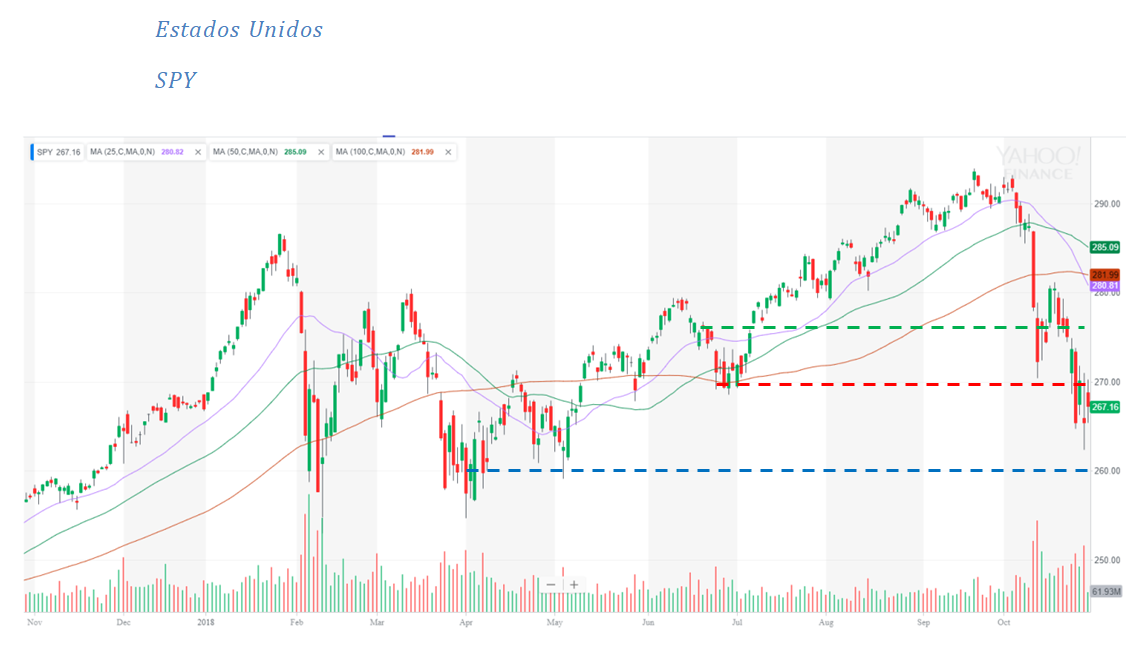

In General, the upward trend in the United States has not been invalidated in strong. However, movements of the past few days have increased significantly the possibility of a change of trend.

We remind that a bull market in the United States is not enough for similar behavior in other developed or emerging countries.

But, It is essential that the price of shares in the United States do not have negative trend to enable hikes in other markets.

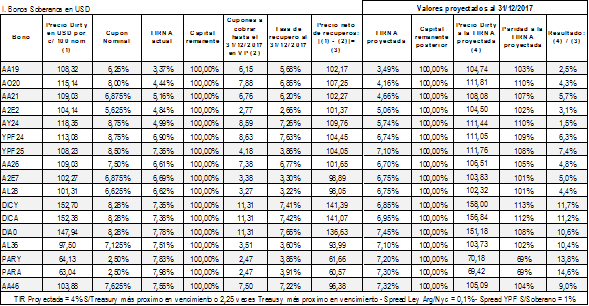

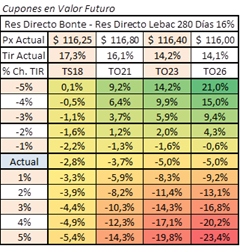

The evolution of the Treasury rate to 10 años, It showed an uptrend even though he was a resistance level around the 3/3,10% annual. The breakdown of this resistance during late September and early October, it accelerated the rise in the interest rate that today sits on the lathe to the 3,25% annual.

Although the hikes in U.S. interest rates. UU. was something expected by markets., such acceleration had impact on the behavior of markets.

We estimate that the rise will continue, reaching the level of 3,50% annual.

In the case of the SPY, It continues into the bullish channel that we have been marking, Although it is currently testing the levels of support. You must assess the level of USD 280 still posing as a level of break key to the formation of a trend change.

Daily casualties of the 1% Or more, just as it is happening on today, they are a negative sign to take into account. We remind you that this ETF is composed by 500 companies.

From mid-October, the euro demonstrates a depreciation of almost a 2,50% with respect to the dollar. At the same time, Since may, the tendency of the value of the dollar against the euro is slightly bullish. Obviously, influences the very high differential rates of interest between United States and Germany.

Analyzing the Germany ETF, EWG, It should be recalled that you priced in dollars while the assets in which invests quoted in euros. That being said, the evolution of the exchange rate becomes important in the behavior of the ETF. At the same time in which the euro depreciated 2,50%, the ETF fell in a 5,50%.

On the other hand, the main trend of the EWG shows a bearish channel main. With the decline of the last days, It is in support of the same levels. Break it down profundizaría falls.

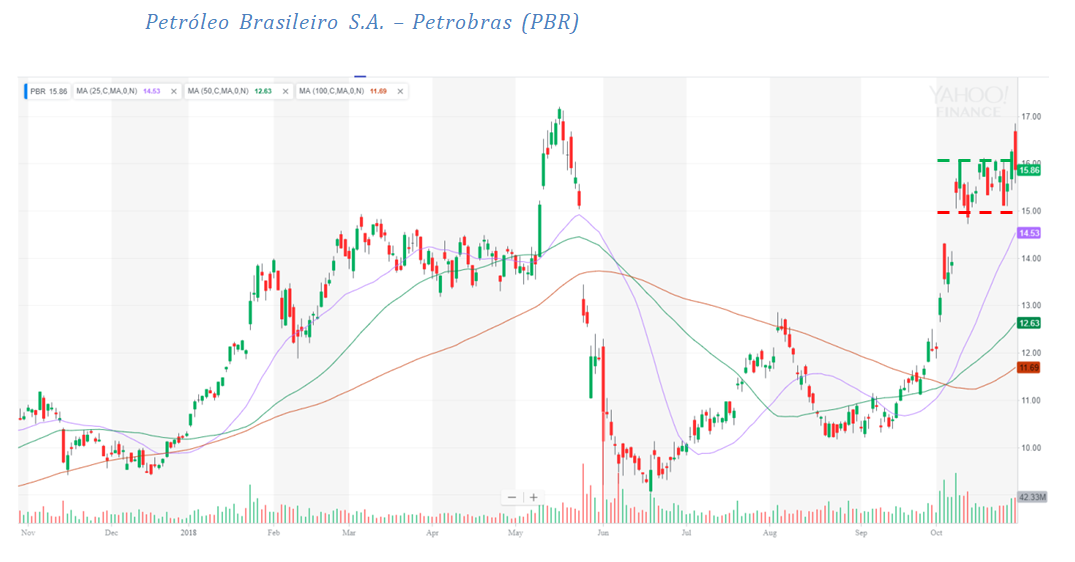

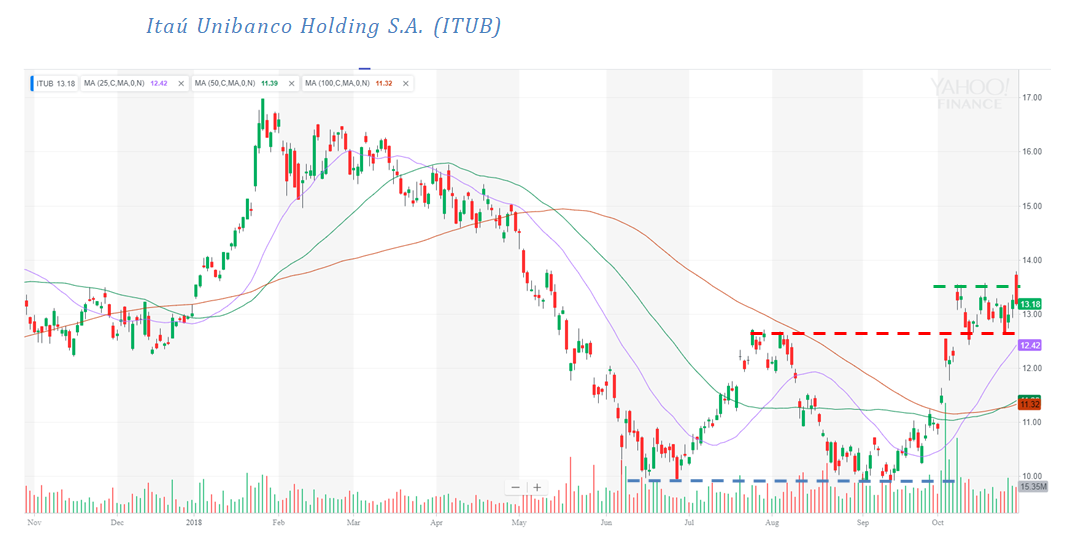

The Brazilian real shows a sharp appreciation of more of the 10% Since the 4,20 Reals per dollar, to the 3,75 BRL/USD today. To technical signals, the current level is presented as a level support key.

Obviously, the final result of the elections and the team that the new President will be key. Is virtually ruled out that the winner is Bolsonaro.

In the same period in which the real has appreciated a 10%, the Brazil ETF (EWZ) He had a bullish rally of almost a 25%.

In terms of technical analysis, the tendency of the EWZ bullish signs, with a double floor around USD 31,50. With the latest rise, it reached the level of USD 40, breaking a resistance that presented at the level of USD 37,50 and that is now presented as a key level to respect as a support.

Achieve sustained above that level would be a positive signal for the formation of an uptrend.

The Turkish lira reached a minimum of 7 lire to the dollar in mid-August. Since then, It showed appreciation to the current levels of 6 TRY/USD. This is, an appreciation of little more than the 14%.

During the same time, the ETF MSCI that follows the Turkish market, showed an improvement of almost a 20% from the achieved minimum mid-August, up to the current level around USD 22,60.

After mark support at the lows reached in mid-August, around USD 20, He recorded successive hikes during the following month, coming to break the main bearish channel on the rise.

It is important to, for the continuity of this new trend, that you hold over USD 21,50.