Fiscal analysis

From 2010 up to 2014, the province maintained a negative and stable operating result, close to the $1.000 million. In 2015, product of a significant increase in expenditures by personnel, It recorded a deficit of $4.900 million pesos. In both, in the cumulative April of 2016, the result shows a surplus of almost $2.000 million.

According to the law on budget of Mendoza, for 2016 We calculated a deficit also close to the $4.900 million. However, at the time of project budget estimated inflation of the 21%, figure that was surpassed widely (builds up 32% en 7 months). In four months, the wage costs, that represent the 56% of the total expenditure, grew 24%. The joint for State employees closed in lathe to the 25%, revisable in September.

The key to the best result in the first quarter, due to the fact mentioned above, the low growth of expenditure on staff in comparison to the current revenue growth.

On the other hand, in the budget approved for 2016 new executions of public works is not contemplated and will only continue that were previous management, What explains the fall of capital expenditures, which represent a 2% budget.

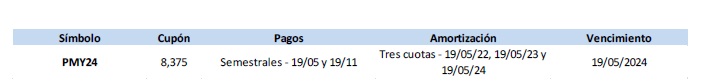

Below are the first quarter revenues 2016:

The structure of revenues of the province is almost equally split between the national and provincial revenues. More precisely, the 52% revenues are of provincial origin ($7.200 million). If add you the sharing Federal revenues by $3.600 million, that means a 26% of the total and that is provide in way automatic, the province has a 78% stable revenues.

The dependence of discretionary transfers by the nation remain indispensable to the mendocino budget, the 22% revenues are hereby. With the devolution to the provinces of the 15% the gross partnership aimed at ANSES, Mendoza will get between a 7% and a 10% more resources for federal partnership. We assume that it will compensate with less discretionary transfers. Lower dependence on discretionary transfers from the province of 22% a 15% in the worst scenarios.

The target budget for 2016 is more than achievable. One factor to take into account will be the evolution of expenditure for the second and third quarter, since obviously will re-evaluate according to inflation much higher initially expected. Anyway the execution of the first semester must be taken as a positive sign.

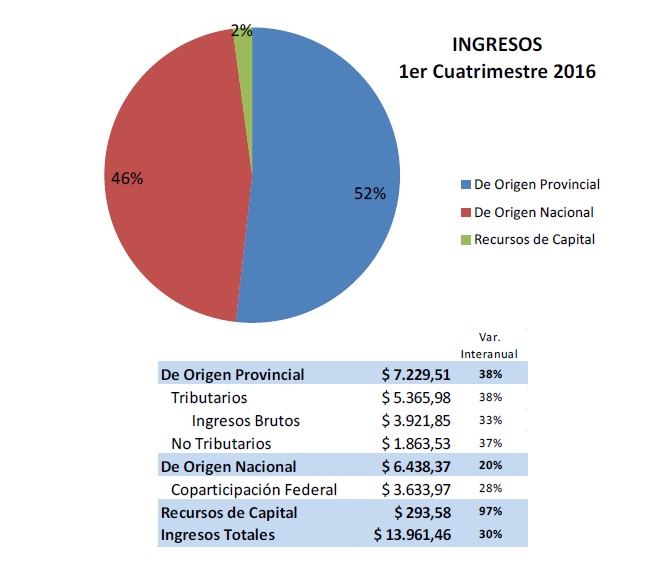

Analysis of debt

Currently, the stock of debt that keeps the province of Mendoza is of approximately $22.300 million. More than half of this is in the hands of national bodies, either State or private. Taking an estimated GDP of $177.800 billion at December 2015 (1), the debt/GDP ratio is of 13%. However, If we take into account that the intra public sector debt may be deemed refinanciable, the ratio is reduced to the 7%, a recommended number.

The composition of the debt by currency, the 59% the debt is in pesos, While the 41% are nominated in USD.

Until 2024 the most significant maturities are recorded, especially debt in dollars. Precisely, en 2017 they will need nearly $3.500 million where $2.500 million francs debt in dollars (USD 166 million). Taking into account the resources of the province, In addition to the recent "opening" of the capital market for the provinces from the output of the default, does not seem to have major problems to meet payments or, eventually, restructure deadlines.

(1) The latest official data available is from 2014, which indicates a PBG's $140.400 million. To calculate the GDP of 2015 It was estimated a growth of the 26,6%, in accordance with the growth of national GDP at current prices.

Conclusion

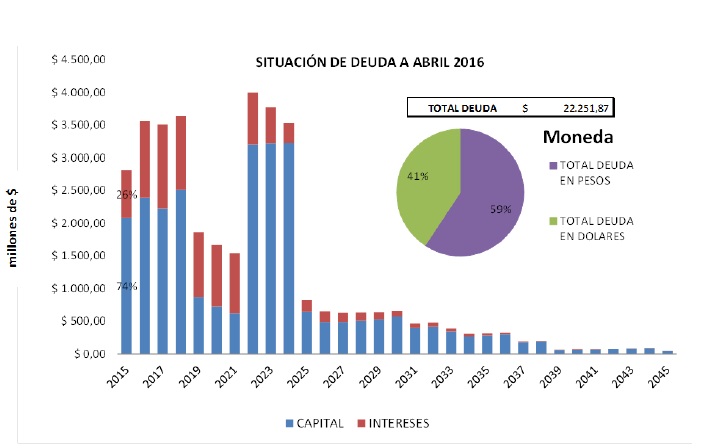

Seen this, the new bonus of Mendoza due in 2024 currently pays a 7% en dólares. In both, the Bonar 24, same time and also in dollars, It is yielding a 5%. If we take into account, as was mentioned, the structure of income is stable and we think that costs can be controlled, the 2 points percentage of difference are consistent and therefore it is recommended allocate a portion less of it portfolio-not more than the 10% -to bonds from Mendoza with expiration 2024. At the same time, the coupon of the bond is of almost a 9%, which gives a nominal coverage (current yield) del 7,5%.